The first invoice discounting marketplace on Blockchain

The first invoice discounting marketplace on Blockchain

Populous is a global P2P (peer-to-peer) invoice discounting platform built on Blockchain technology. We combine the trust, transparency, security, and speed of Blockchain with our proprietary smart contracts to directly pair invoice sellers and lenders to transact directly and without third parties.

Our proprietary smart contracts reduce risk by utilising XBRL data, Altman Z-scores, and other data to ensure the strong financial credit worthiness of businesses that want to sell invoices.

Blockchain technology opens the doors for everyone to participate in an alternative finance marketplace. In the past, financing was only available through banks and financial institutions which have high fees and other barriers to entry. Blockchain financial technology opens the marketplace for all investors and all invoice sellers to work together for mutual benefit by removing these barriers.

Perhaps the largest barrier to entry for both invoice sellers and investors is the geographic limitation in the current model. By using the fiat-pegged Poken cryptocurrency on our platform, invoice investors and invoice sellers can work together globally. For example: an investor from China or Japan can freely invest in invoices sold by UK businesses and vice versa. The Poken creates a stable trading environment by being pegged to virtually any given currency and is Ethereum ERC20 compliant.

Banks and other financial institutions have attempted to create alternative financial platforms on the blockchain, but these platforms are limited by banking and finance industry regulation. Populous will replace this legacy platform because we are not limited by these regulations.

Block chain technology eliminates the inefficiencies and risks of manual contract origin and processing, associated manual errors, and duplication of invoice financing. This makes value propositions such as micropayments more feasible.

For example, when a smart contract is executed between an invoice buyer and a invoice seller, 80% of the funds will be released to the invoice seller via the smart contract. Payment is only confirmed when the transaction is entered into the distributed ledger and the crowd-funding process is then closed. All legal requirements are written into the smart contract which are legally binding when executed.

The smart contract prevents fraud since the smart contract will not allow invoices that have already been financed to receive duplicate financing. Therefore, a smart contract acts as a built-in protective layer on a Blockchain ledger.

Blockchain technology is the future as it enable more efficiencies to be built-in such as decreasing the requirement to manually process and initiate contracts, reduces risk through the elimination of manual errors and duplication of invoice financing which could make value propositions such as micropayments more feasible.

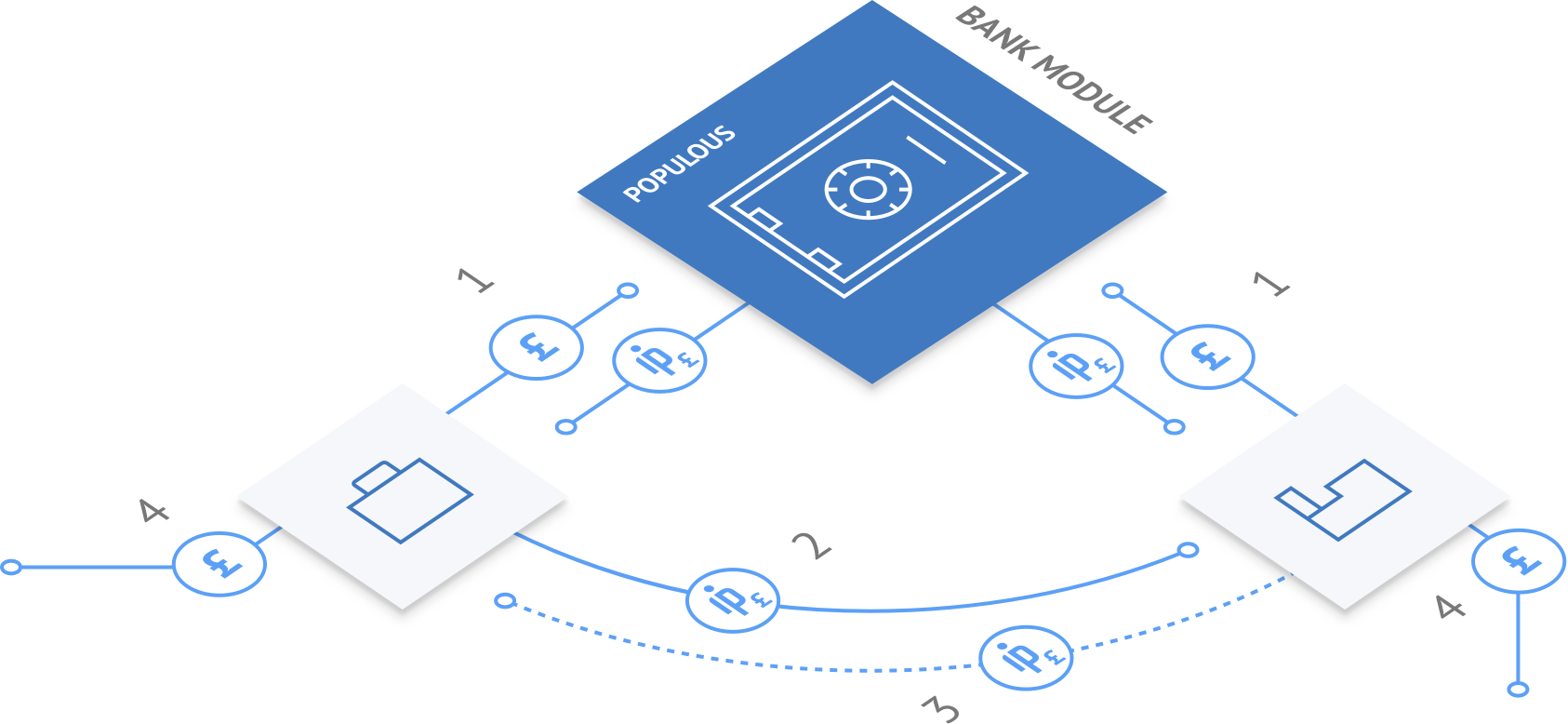

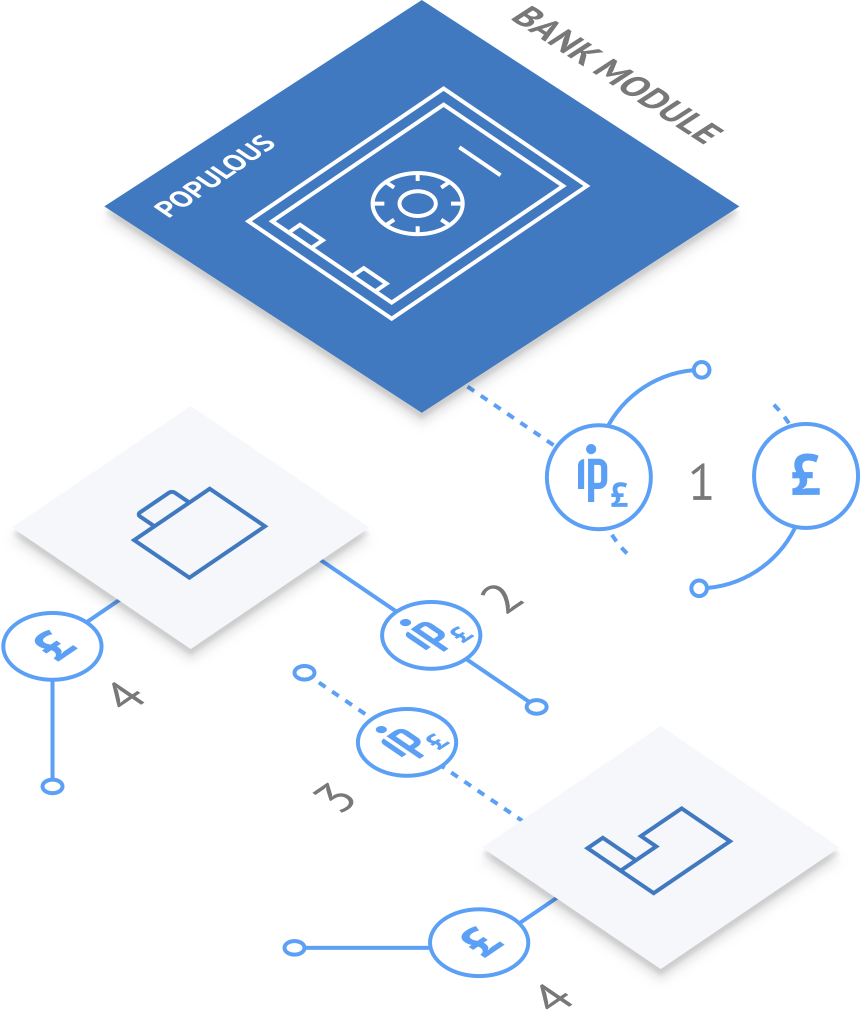

The flow of funds within the platform are made possible through the use of custom stable currency tokens called Pokens. Pokens are pegged 1:1 with the national government currencies involved in a given transaction. For example: £8 GBP are represented by 8 Pokens (GBP). All transactions between invoice buyers and sellers will be executed via Pokens.

Since Pokens are ERC20 compliant, they allow us to take full advantage of the smart contracts on the Ethereum Blockchain. The use of the custom stable Pokens shields the invoice buyers and sellers from market volatility. They also allow us to support currencies from any part of the world without the need of third parties.

Poken Sign

Currency to which Poken is pegged

The base currency for the Poken is a given national fiat currency based on the needs and location of the transaction. Pokens are initially tied to the British Pound (GBP).

Participants can convert their GBP Pokens to Pokens of other currency denomination within the platform. For example, the participant can convert their GBP Pokens for USD Pokens based on prevailing conversion rate set by the London Stock Exchange. All currencies will be set by the national stock exchange of the territory.

Fund deposits can be made in Bitcoin which are exchanged for Pokens according to an aggregated BTC/USD pair exchange rate at time of deposit. On withdraw, Pokens can be exchanged for any supported government's currency or well-established cryptocurrencies such as Bitcoin or Ethereum.

XBRL (eXtensible Business Reporting Language) is a global standard for exchanging business information and is freely available to anyone. It is developed and published by XBRL International, Inc. We use XBRL to define and exchange financial information.

Companies submit financial statements to government regulators each year. XBRL uses these statements and internationally standardises these data so they can be reviewed and compared regardless of geographic origin.

We have built a XBRL back-end as part of our in-house credit reference system and targeted marketing database. With this XBRL engine we extract useful data that gives us the ability to foresee multi-industry trends in real-time. This data comes from more than 2 million sets of financial statement we collect each year as they are filed with the UK Companies House.

We currently collect approximately 1 petabyte of data (or nearly 20 million, 4 drawer filing cabinets filled with text documents) every 6 to 12 months. Our automated analytical tools develop useful insights from this exceptionally large amount of data. These financial data insights flag opportunity/risk which are directly used on the Populous platform to reduce the costs of short term funding for invoices.

* this is only a small part of data we extract from XBRL.

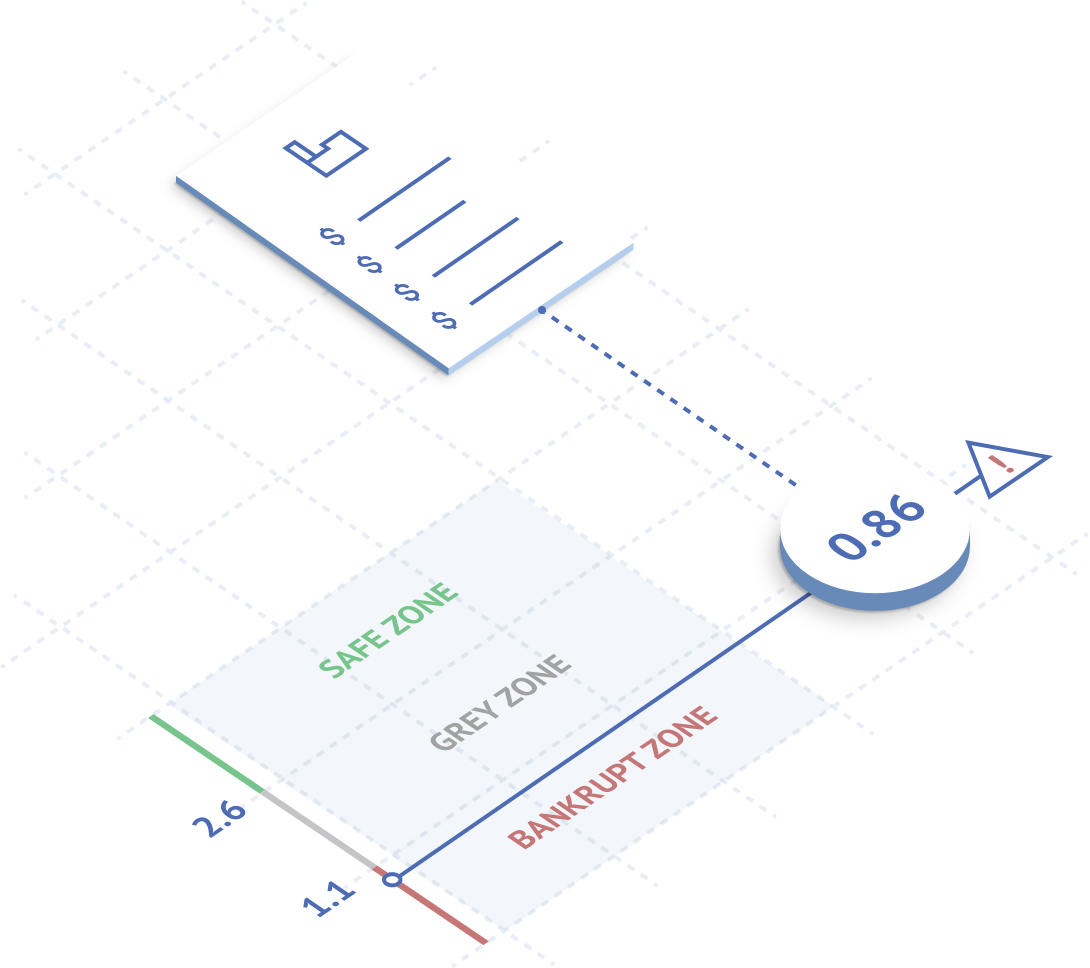

The Z-score formula published in 1968 by Edward I. Altman is a standard formula used globally in the financial industry. The formula provides three predictive measures: i) the probability that a business will go into bankruptcy within two years, ii) whether or not a business will default, iii) a control measure for financial distress.

With the combination of extracted XBRL data and the Altman Z-Score formula we have not only bypassed the need to use an external credit reference agency, but have also gained a technological and financial edge over our competitors.

By combining these data sets, we are able to more effectively target companies in need of cash flow. The same data sets can be used for many other business use cases, but we are currently focusing on the invoice finance industry and will seize a significant portion of market share from our main competitors.